Westminster Seminary California Misrepresented its Receipt of Federal Funds

Seminary received federal funds while its publications and fundraising campaigns said otherwise

Audio of this article is included here. Please note that the audio does not contain notes and citations.

Update 23 Jan 2024: I added a clarification to footnote 4 regarding the portion of HEERF funding distributed to students.

Update 23 Jan 2026: WSCAL recently again published in the Fall 2025 UPDATE the claim regarding direct funding from the government.

I had hoped that my last piece on Reformed seminaries and their use of federal student loans might be my final look at the issue, at least for a while. However, not long after writing that piece, I stumbled upon something that may, in fact, raise the stakes of that discussion considerably.

My previous concerns expressed in the loan piece and the COVID funding piece were questions of wisdom and prudence regarding the receipt of federal funds from a federal regime that is firmly committed to anti-Christian agendas and practices. This remains an open question. I believe rather strongly that seminaries should eschew federal funds (and even federally recognized accreditation) because they pose risks and dangers to the schools and potentially compromise their independence and objectivity on issues such as human sexuality and the role of women, since the federal government is clearly committed to feminism, the LGBT agenda, and diversity, equity, and inclusion ideologies. Others have clearly arrived at different conclusions.

However, I discovered something in follow-up research that reaches beyond the bounds of mere questions of wisdom and prudence and into questions of truthfulness and integrity. This matter pertains to my alma mater, Westminster Seminary California. They have appeared repeatedly in my articles as they have used every form of federal funding I have investigated (HEERF grants and PPP forgivable loans provided in COVID relief legislation, and federal direct student loans). They are far deeper into federal programs and funding than most other Reformed seminaries, joined only by Covenant Theological Seminary and Westminster Theological Seminary in Philadelphia as schools which have used all three.

Now, if WSCAL wants to dismiss my concerns of wisdom and prudence and continue to use federal funding, I suppose that is their prerogative. However, a problem arises in how WSCAL has communicated its sources of funding to its donors, alumni, and churches.

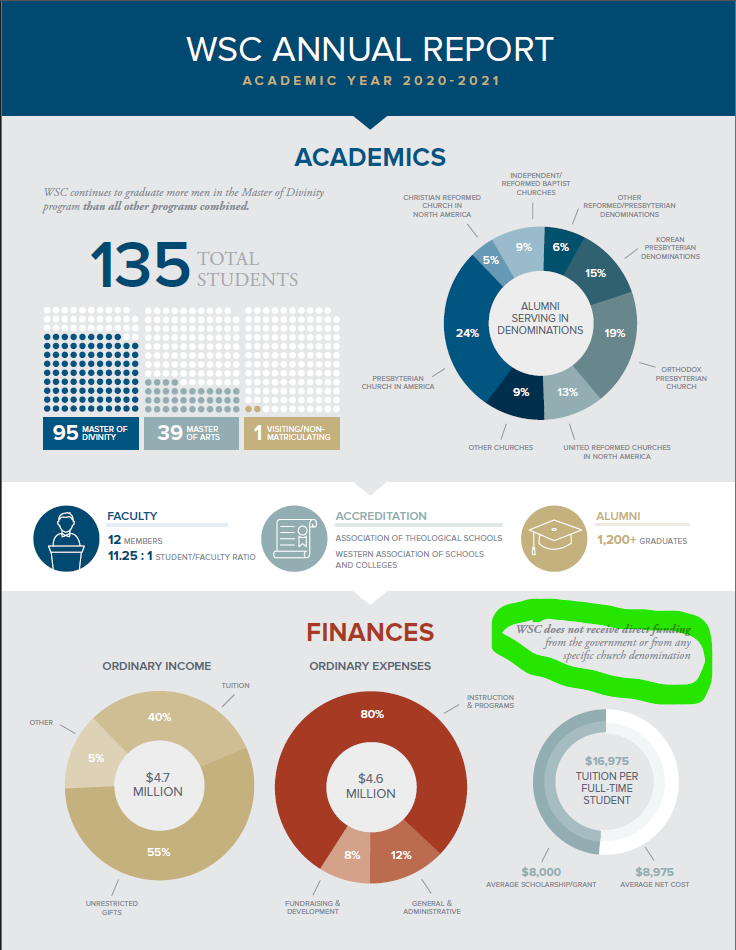

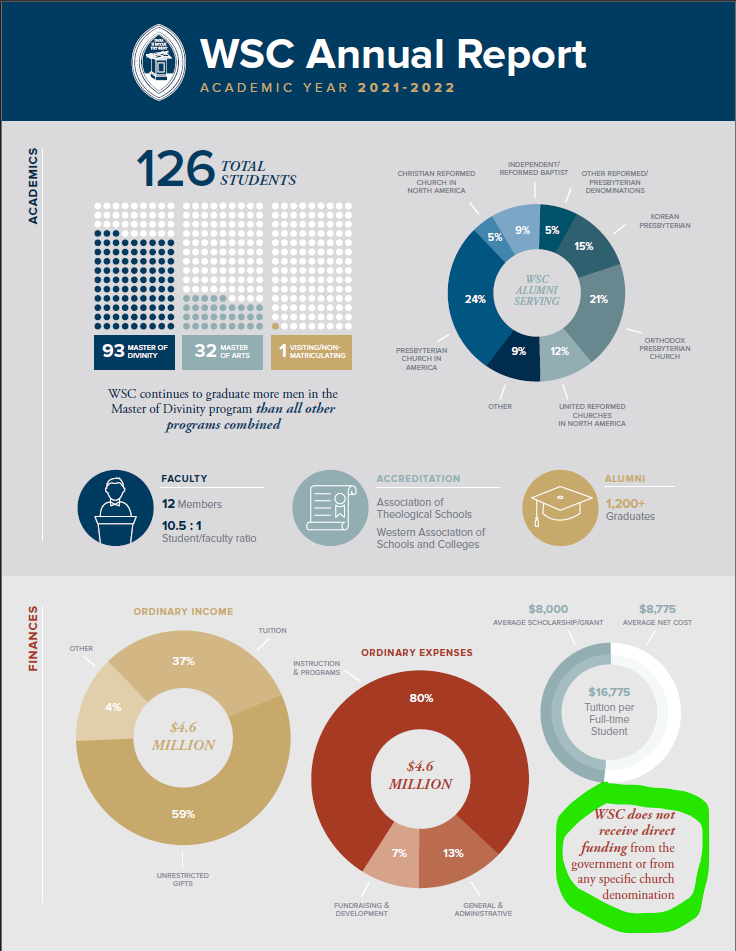

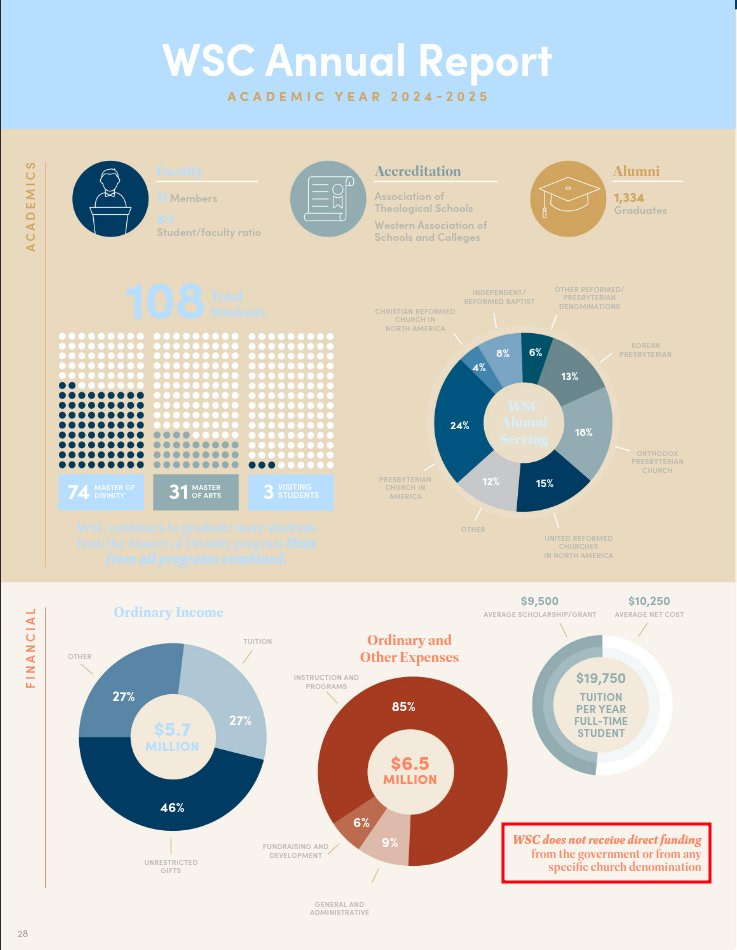

Twice per year (spring and fall) WSCAL publishes UPDATE magazine, its publication for alumni, churches, and donors. In each fall issue since at least 2014, they have included an Annual Report, a basic summary of the seminary’s financial position. This report is also posted separately every year in the donor-specific section of WSCAL’s website. This itself is a perfectly fine and reasonable practice. However, the problem is that in every year since at least 2014, that Annual Report has included the following statement: “WSC does not receive direct funding from the government or from any specific church denomination.” Of particular interest to my investigation, I want to show you those reports since 2020.

Fall 2020 UPDATE - page 22

Fall 2021 UPDATE - Page 23

Fall 2022 UPDATE - page 24

Fall 2023 UPDATE (the most recent issue at the time of publication) - page 29

(updated Jan. 23, 2026) Fall 2025 UPDATE

Another statement made on the webpage of WSCAL’s building fundraising campaign1 is similar but more detailed, presented as Q&A:2

Q: Does Westminster Seminary California receive governmental or denominational funding?

A: No. Because WSC is a private education institution, it does not qualify to receive state or federal funding. WSC receives no denominational support except from those individual congregations that include WSC in their annual budgets or periodic offerings.

Now, if you have been here for my various deep dives into seminaries and the federal funding machine, you likely have an idea as to why this is a problem. But in case you are new, allow me to explain:

Since 2020, WSCAL has disbursed over $2 million in federal direct student loans. I explained how I arrived as this figure and the data sources and methodology I used in my previous article. In preparation for this article, I dove a little deeper into the federal historical data and found that WSCAL began participating in the federal direct loan program during the 2010-2011 award year. This would have coincided with the end of the Family Federal Education Loan (FFEL) program. Under FFEL, federally guaranteed student loans were obtained through third party lenders. After the end of FFEL, federal student loan funds were obtained directly from the government and disbursed through schools. This means that at least since 2014, UPDATE and the Annual Report have claimed that WSCAL does not receive “direct funding from the government” while participating in the federal direct loan program. This language of “direct” referring to the loans is not my own, it is the Department of Education’s own terminology used to describe them. These are loan funds that are disbursed directly from the federal government through schools to cover education-related costs. Now, I realize some may quibble over these loans being considered “direct funding” because they are loans taken out by students, even if through and for the benefit of schools. I will momentarily grant this for the sake of argument. However, it does not solve the problem of “direct funding” in the Annual Report claim and does not address the building campaign claim at all.3

WSCAL also took two forms of federal aid following the COVID-19 pandemic. I documented this at length in my previous article on those programs. This is where the claim of no “direct funding from the government” becomes particularly problematic, and why I particularly pulled the Annual Report documents from 2020 onward. WSCAL took two forms of aid at that time made available by federal appropriations passed in 2020 and 2021— $545,200 in forgivable loans through the Paycheck Protection Program, and Higher Education Emergency Relief Fund grants totaling $646,967, of which $629,942 was spent.4

One might quibble that PPP funds came as loans through banks, and thus do not qualify as “direct funding from the government.” It is true that this money was “loaned” through banks. However, these were not typical bank loans made for typical reasons. These were loans made only because the federal government guaranteed the loans and promised to come in and pay them off afterwards—there was no intention on the part of banks to carry these loans on their books for a prolonged period and no intention on the part of borrowers to pay them back. In WSCAL’s case, the loan was taken then later forgiven with interest—the government paid. Furthermore, if one will argue that PPP is not “direct funding from the government” because the money comes from the bank, one will have a difficult time arguing that federal direct student loans are not, because that money does come directly from the government. The distinction that disqualifies one qualifies the other. But once again, only temporarily and only for the sake of argument, I will grant that PPP might not, on a pure technicality, constitute “direct funding from the government.” This still does not solve the “direct funding” problem of the repeated annual report claim, and still does not address the broader claims made in the building campaign.

Finally, there remains the HEERF funding. The HEERF program was a grant program—it was not and never attempted to be a loan program, and the money was disbursed directly from the federal government to schools. I do not see how even the narrowest possible definition of “direct funding from the government” can explain how the $646,967 in HEERF funding that WSCAL was awarded in 2020 and 2021 (of which $629,942 was documented as spent) was not “direct funding from the government.”5

And yet, WSCAL continued during this time to release its annual report to donors representing that “WSC does not receive direct funding from the government” and to run the building campaign that claimed no use or eligibility for federal funding at all. “Now Andrew,” you might argue, “this was probably just a matter of clerical oversight. They put out that report every year and the building campaign went on for several years and it was probably just some boilerplate language that has been kept in the whole time.” Maybe it was, maybe it wasn’t. It still is a significant problem. UPDATE essentially exists to provide information to donors, churches, and alumni (churches and alumni who are frequently also donors). Whatever else it may be, a core function of UPDATE is to serve as a solicitation for donations; it exists to tell current and prospective donors the great work the seminary is doing so that they will begin to donate or continue to donate to that great work. And, of course, the whole of the building campaign is a donation solicitation. Now, soliciting donations is fine and necessary. Seminaries, like all nonprofit organizations, need donations to stay afloat. However, it is of the utmost importance that any solicitations for donations reflect true and accurate information about the organization.

This standard for donor communications, by the way, is not just my own personal pontification. It is industry standard and also required by law. WSCAL is accredited by the Evangelical Council for Financial Accountability (ECFA), an organization which exists to ensure financial transparency, board governance, and proper stewardship of charitable gifts among Christian organizations. ECFA prescribes standards which its accredited organizations are expected to follow. Standard 7.1 is particularly applicable here.

7.1 Truthfulness in Communications

In securing charitable gifts, all representations of fact, descriptions of the financial condition of the organization, or narratives about events must be current, complete, and accurate. References to past activities or events must be appropriately dated. There must be no material omissions or exaggerations of fact, use of misleading photographs, or any other communication which would tend to create a false impression or misunderstanding.

The ECFA provides commentary on this standard, explaining how it is to be applied by accredited organizations (emphasis in italics mine).

In deciding whether to support a particular ministry or program, those who donate to Christ-centered organizations may significantly rely on the information the organization provides. Therefore, organizations have the responsibility to represent facts truthfully when communicating with givers.

The relationship between the giver and the organization is one built on trust. That trust is developed and maintained through truthful, honest, reliable, and trustworthy communications. Anything short of that represents a violation of this standard.

The intent of this standard is to insure (sic) that all components of a stewardship resource appeal—taken in part and as a whole—communicate the appeal accurately, completely, and truthfully to the prospective giver. After reading or hearing the appeal, the prospective giver’s perception of the appeal should be as close to the actual facts as possible.

In order to accomplish this, the organization preparing the appeal must anticipate how the typical reader will interpret them. The organization should avoid any words, pictures, graphs, or other information that might cause a typical prospective giver to reach an inaccurate conclusion.

Furthermore, from that same commentary:

Accurate. All information included in an appeal should be accurate; that is, factual, correct, exact, and precise. The key concern here is that nothing within the appeal (words, pictures, videos, financial data, or other information) misleads the prospective donor into believing something other than the facts as they actually exist. This relates not only to the purpose of the appeal but also to the way in which the funds will actually be used.

Inaccuracies may appear in a number of forms: 1) photographs that do not directly relate to the issue at hand; 2) exaggerations for the sake of persuasion; 3) incomplete information which does not provide a full understanding of the facts; 4) implications which would lead the prospective donor to draw an erroneous conclusion; 5) selective information which presents only the positive while ignoring relevant, negative information, and 6) opinion which is presented as fact. The appeal must avoid any of these inaccuracies used.

Earlier I mentioned some potential objections that might be raised to the assertion that WSCAL’s participation in some of these programs constitutes receiving “direct funding from the government.” I demonstrated that at least one funding source (HEERF) is indisputably direct funding from the government. However, even if there is some loophole or technicality by which the other two do not qualify, the fact that loopholes and technicalities are required to defend the statement shows that the statement is not being made with the ECFA’s “typical reader” in mind. The typical reader would likely read WSCAL’s annual report and reach the conclusion that WSCAL is not taking government money (and the broader statements in the building campaign seem to confirm that this is what is being claimed). And yet WSCAL has qualified for and taken and used government money in various forms for years.

Continuing to make these statements about government funding appears to be (whether intentional or not) a solicitation of donations under false pretenses. Nothing particularly demands that WSCAL assert that they do not receive government funding. Leaving aside for a moment my concerns about seminaries and federal funding, WSCAL (contrary to their claims in the building campaign) is eligible to receive various forms of government funding and have, as far as I can tell, legally and legitimately participated in these federal programs. The problem is that WSCAL misrepresented the seminary’s activities and funding sources to donors, both in regular and campaign-specific communications. The claims about government and denominational funding are meant to incentivize donors. They communicate that WSCAL does not receive funds from these other sources and so it needs more donations from private donors and individual congregations. How many of WSCAL’s donors have given or increased giving because they believe in the righteousness of the cause of a seminary seeking to operate independent of Uncle Sam’s purse strings (in my view, a very noble cause—the one that has motivated all of these articles I have written)?6

But what if the language is just outdated boilerplate? The annual report gets redesigned each year, and the statement itself has been redesigned with different fonts at least three times since 2014, so its continued presence seems intentional. The building campaign has also continued the entire time. And yet, even if this is a matter of failing to delete something outdated, the left hand not knowing what the right is doing, it still represents an institutional failing. I will again quote ECFA’s commentary on its standard 7.1 (emphasis in italics mine):

Current. An appeal for charitable gifts should only contain information that is specifically relevant to the purpose of the appeal. Using pictures, videos, descriptions, narratives, or other information from prior projects or events—which suggests a misleading relationship with the current appeal—is a violation of this standard. The prospective giver will assume that all of the information presented relates to the specific appeal. It is inappropriate to use “old” information in a current appeal simply because it might bring a “better” response from a giver.

When addressing financial information, the appeal should provide information that is as current and timely as possible. The prospective giver should have access to the most current financial information available. The key criteria is whether or not the information provided gives the prospective giver a true understanding of the relevant financial information as of the date of the appeal.

In other words, the use of outdated information is inappropriate, especially when that outdated information produces a “better” response (i.e. more and larger donations). The language on government funding, if it was true at some point in the past, should have been deleted from the annual report and building campaign once the circumstances changed. For an organization through which millions of dollars from private donors and church congregations flow each year, keeping websites and once-a-year publications current is not too much to ask, especially when the non-current information incentivizes donors. Whether the statement was always untrue or became untrue somewhere along the way, that untruth likely caused people and churches to part with their money. They donated under false pretenses. Whether WSCAL solicited donations under false pretenses intentionally or unintentionally is an open question, but the intent does not change the damage. Unintentional sins remain sins (Leviticus 4:1-3).

These statements in the fundraising solicitations not only violate the ECFA standards, but they may also constitute a violation of California law. According to California Government Code - GOV § 12599.6,

(f) Regardless of injury, the following acts and practices are prohibited in the planning, conduct, or execution of any solicitation or charitable sales promotion: …

(2) Using any unfair or deceptive acts or practices or engaging in any fraudulent conduct that creates a likelihood of confusion or misunderstanding…

(6) Misrepresenting or misleading anyone in any manner to believe that goods or services have endorsement, sponsorship, approval, characteristics, ingredients, uses, benefits, or qualities that they do not have or that a person has endorsement, sponsorship, approval, status, or affiliation that the person does not have.7

Paragraph (2) of this statute introduces a new word to this discussion, “fraudulent.” I have been hesitant to speak of fraud thus far, but if WSCAL has intentionally continued to promote their non-receipt of government funds while receiving government funds, this is fraud. If unintentional, this remains serious negligence and a violation of donor trust on the part of a nonprofit organization.

I would now like to address some likely objections I will receive. Some will accuse me of violating the ninth commandment by openly reporting on these issues. I have a clear conscience regarding the truthfulness of the matters I have put forward here. They are based on information that is already public and amply documented. Furthermore, while this report may result in reputational damage to WSCAL, this only comes because WSCAL has publicly breached its duties under the eighth8 and ninth9 commandments. I have even granted that this may have happened unintentionally, but it still happened, still has consequences that may have resulted in harm to others, and still requires repentance.

Some will likely accuse me of violating Matthew 18 by publishing this information rather than first addressing the matter to WSCAL directly and privately. Matthew 18 applies to private sins between individuals. In this case, there is a sin that has been committed in public for years. I do not know, WSCAL does not know, and likely no one knows for sure how much and how many donations they have received because donors believed that WSCAL received no government funding. Even if WSCAL were to on its own initiative retract and amend its long history of statements about not receiving federal funding, it would not undo the damage done because the money has been given and spent and there is likely no going back. Even if WSCAL offered to refund donations of donors who believe they were misled, some donors are likely no longer living, as charitable donations skew towards the elderly and WSCAL has long encouraged estate giving.10 Furthermore, a proportionate and biblical response to a public sin is public confrontation of the sin. Paul practiced this in Galatians 2:11-16, confronting Peter “before them all” (the church) regarding his scandalizing behavior that impacted the entire church. WSCAL is not a church nor part of a church—it deliberately and structurally operates independently of the church, though many of its faculty and staff are officeholders in various NAPARC churches. I do not know which particular individuals within WSCAL are responsible for this misrepresentation. As WSCAL has undergone significant administrative and staff turnover in recent years, there are likely several individuals who contributed in their own way. I would not have opposed dealing with the matter in church courts if any church court existed that held proper jurisdiction, but there is none. Even the current governance structures of WSCAL do not reach to all parties responsible and wronged. Further, UPDATE and the Annual Report are public documents that are circulated far beyond the bounds of any particular church or denomination. WSCAL mass mails them to churches, alumni, and donors and posts them online for all to see. If there was some way to adequately address this matter without public confrontation, I would have preferred it. The same also applies to my COVID money and loan articles—these are public matters in the public record that involve the federal government, the most public of all entities. There is no way to effectively address these matters non-publicly. Furthermore, the Westminster Larger Catechism, while having concern for reputation in its treatment of the ninth commandment, also forbids “concealing the truth, undue silence in a just cause, and holding our peace when iniquity calleth for either a reproof from ourselves, or complaint to others…” (WLC 145).

Finally (and I hesitate a bit to bring this up), some might accuse me of bearing some vendetta against my alma mater. “He’s just a disgruntled former student, don’t listen to him.” Any who have followed my work know that I have at times expressed disagreements and disappointments with some of WSCAL’s teachings and practices, both those I observed while I was a student and others that have come to my attention since. Those disappointments and disagreements are real, and there is no reason to pretend they are not. That said, I have always been open to discuss these matters with WSCAL’s personnel and supporters. I still have the same phone number and personal email address as when I was a student. I have gone to great lengths to be fair and truthful in my critiques and apply them fairly across the board to other institutions where they apply. It is certainly possible, perhaps even likely, that I have at times in these endeavors failed and sinned in my conduct. But other than a few occasional bouts of defensiveness on social media from certain individuals, there has been relative radio silence in my direction from WSCAL since I graduated there in 2021. However, as a courtesy, I did reach out to WSCAL for comment three days prior to publication. I received no response.

I stand firmly upon the conviction that it is not failure or sin to bring to the light what is done in darkness, especially when it carries serious and public implications for Christ’s church and her members. The church needs institutions that are worthy of her, the bride for which Christ shed His blood. I long for the day where we might have more of those institutions, either by reforming existing ones who have lost their way or by building anew. The institutions we have now need to take a long look in the mirror (particularly the mirror that is God’s word and our Reformed standards) and purge sin, corruption, negligence, and incompetence from their ranks. Until they do, those of us who notice have a duty to speak the truth and will continue to do so.

Andrew Smyth is the pastor of Westminster Orthodox Presbyterian Church in Hamill, SD, and the co-host of Once for All Delivered.

While included in information about the housing campaign, the Q&A seems to be making universal statements about WSC (such as its mission statement) and the charts refer to a full-year ordinary income and expenses of the seminary, so the language about the exclusion of federal funds does not appear to be referring exclusively to the housing campaign. As far as I can tell, this campaign is ongoing—the webpage is live, and it still accepts designated donations. This makes sense as not all of the buildings called for in the campaign (such as the new educational building) have been constructed at this point.

The building campaign appears to have begun in the mid-2010s (the land was purchased in 2014 [archive link]), which means WSCAL was in the direct loan program by then. The earliest instance of the page available on the Wayback Machine is from June 2017, and it includes the Q&A on governmental and denominational funding.

In my original reporting on COVID funding I used third-party aggregators to determine the amounts schools took under these programs. Since then, the federal government has published its own data which is more specific and detailed. The previous HEERF figure for WSCAL did not include $464,210 granted under the Fund for the Improvement of Postsecondary Education. (Clarification 1/23/2024: $66,942 of the HEERF funding was distributed by the school to students as grants for pandemic-related costs. The remainder appears to be money for the school).

It should be noted that, according to the more detailed financial data WSCAL reported to the ECFA [archive link], they ran significant operating surpluses in the fiscal years ending June 2020, 2021, and 2022. There does not seem to be any particular fiscal emergency brought by the pandemic that required WSCAL to take these funds as a matter of institutional continuity.

I researched to see if there was some unified legal definition of “direct” federal funding. The short answer is no. One set of definitions is provided in 45 CFR 87.1 (within the purview of the Department of Health and Human Services). A different distinction between “direct” (or “mandatory”) and “discretionary” spending is provided by the Congressional Budget Office regarding federal appropriations. One explanation of “direct Federal programs” provided by the White House interestingly specifically includes “higher education loans to individuals.” All of this to say, there does not appear to be a unified or recognized legal definition of “direct funding” that explains WSCAL’s claim.

I looked at similar documents and publications from Westminster Theological Seminary in Philadelphia and Covenant Theological Seminary, since they are WSCAL’s closest peers in the depth and breadth of federal funds they use. As far as I can tell, neither school has made similar claims to WSCAL on the receipt of federal funds. While I continue to question the wisdom and prudence of these schools in using these funding sources, it does seem from my limited research that WTS and Covenant are exercising the requisite transparency and integrity in using them.

Crimes and penalties of this sort are described under California Penal Code § 532.

Westminster Larger Catechism, which is one of WSCAL’s doctrinal standards. Q. 141. What are the duties required in the eighth commandment?

A. The duties required in the eighth commandment are, truth, faithfulness, and justice in contracts and commerce between man and man…

WLC Q. 144. What are the duties required in the ninth commandment?

A. The duties required in the ninth commandment are, the preserving and promoting of truth between man and man, and the good name of our neighbor, as well as our own; appearing and standing for the truth; and from the heart, sincerely, freely, clearly, and fully, speaking the truth, and only the truth, in matters of judgment and justice, and in all other things whatsoever…

Scott Clarke better watch a little closer who he attacks, Thank you Andrew for under covering the hypocrisy!!